ECN 201, Spring 1997

Prof. Bruce Blonigen

NAME: __________________________

SS#:

__________________________

****************************************************************************

Directions: This test is comprised of 2 parts for a total of 140 points. The first part is 40 multiple choice questions, with each question worth 2.5 points for a total of 100 points. The second part is short answer problems worth a total of 40 points. Mark your multiple choice answers on a Scantron with a #2 pencil. Put your name and student ID number on both the Scantron and this test. Then hand in both the Scantron and the test when you are finished.

1) The concept of opportunity cost

a) is relevant only to economics.

b) can be applied to the analysis of any decision-making

process.

c) applies to consumers but not to firms.

d) refers only to actual payments and incomes.

2) Which of the following is an example of a positive statement?

a) The federal government should be required to have a balanced budget.

b) Local governments ought to impose rent controls to allow people

to afford housing.

c) Studies indicate that the imposition of a minimum wage

increases unemployment.

d) The government must impose taxes on imported goods to protect

the jobs of

American workers.

3) An efficient economy is an economy

a) in which output is steady or growing and there is low inflation.

b) that produces what people want and does so at least cost.

c) that distributes output equally among all consumers.

d) in which there is a fair distribution of wealth.

4) A graph with the value of the minimum wage on one axis and the level of teenage unemployment on the other axis is an example of

a) an economic theory.

b) a model.

c) inductive reasoning.

d) a variable theory.

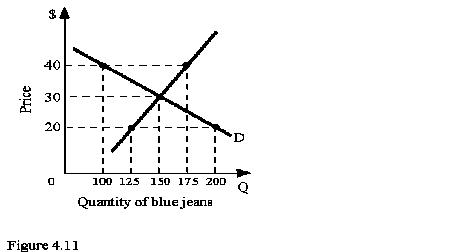

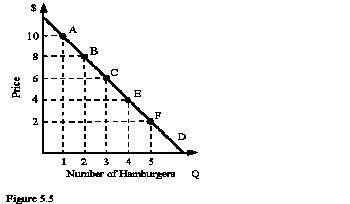

5) Refer to Figure 4.11. At a price of $20, there is an

a) excess demand of 75 blue jeans.

b) excess demand of 50 blue jeans.

c) excess demand of 25 blue jeans.

d) excess supply of 50 blue jeans.

6) Refer to Figure 4.11. If this market is unregulated and the price is currently $40, you would expect that

a) the price of blue jeans would remain at $40, because firms would not want to reduce

the price.

b) the price of blue jeans would fall to $20, so the firm could

sell its excess supply.

c) the price would fall, but the new price is indeterminate from

the information provided.

d) the price would fall to $30, where quantity demanded equals

quantity supplied.

7) If the government imposes a price ceiling that firms cannot charge more than $40 in this market. Then

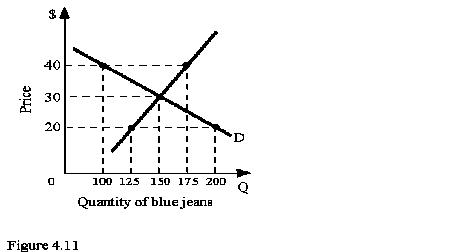

8) Refer to Figure 5.1. The market is initially in equilibrium at point B. If demand shifts from D2 to D1, the new equilibrium price will be ______ and the new equilibrium quantity will be _______.

a) $4.00; 350

b) $3.00; 250

c) $3.00; 400

d) $4.00; 150

9) Refer to Figure 5.1. The market is initially in equilibrium at point A. If demand shifts from D1 to D2 and the price of chicken remains constant at $3.00, there will be

a) an excess supply of 150 million pounds of chicken.

b) an excess demand of 150 million pounds of chicken.

c) an excess supply of 50 million pounds of chicken.

d) an excess demand of 100 million pounds of chicken.

10) Refer to Figure 5.1. The market is initially in equilibrium at point A and demand shifts from D1 to D2. Which of the following statements is TRUE?

a) There is no need for price to serve as a rationing device in this case since the new equilibrium quantity is higher than the original equilibrium quantity.

b) Because demand increased instead of supply, decreasing quantity

and not price will be the rationing device.

c) The market cannot move to a new equilibrium until there is also

a change in supply.

d) Price will still serve as a rationing device causing quantity

demanded to fall from 400 to 350 million pounds of chicken.

11) If there is a large increase in the quantity of potatoes exchanged, but little or no change in price, the most likely explanation is that:

a) supply has increased and demand has

decreased.

b) both supply and demand have increased.

c) only supply has increased.

d) supply has decreased and demand has

increased.

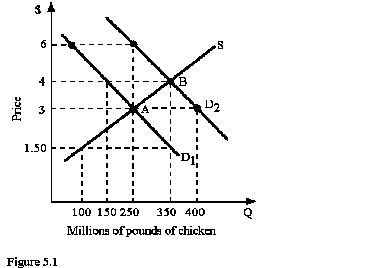

12) Refer to Figure 5.5. If the price of a hamburger is increased from $2 to $4, the price elasticity of demand over this rang from F to E equals

a) -1.00.

b) -0.50.

c) -0.20.

d) -2.00.

13) Refer to Figure 5.5. At point C the price elasticity of demand is -1. Along line segment BC of the demand curve, the demand is

a) elastic.

b) unitarily elastic.

c) inelastic.

d) either elastic or inelastic depending upon whether price

increases or decreases.

14) Brumbling State University decides to raise tuition to increase the total revenue it receives from students. This strategy will work if the demand for a Brumbling education is

a) elastic.

b) unitarily elastic.

c) inelastic.

d) inversely related to price.

15) If the owner of an ice cream store charges a $1.20 for an ice cream cone his total revenue is $540 a day. If he lowers the price to $1.00 his total revenue is $500 a day. The demand for ice cream is

a) inelastic.

b) elastic.

c) unitarily elastic.

d) neither elastic nor inelastic because

this situation violates the law of demand.

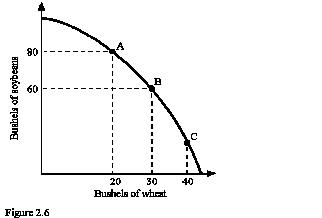

16) Refer to Figure 2.6. For this economy to move from point B to point C so that an additional 10 bushels of wheat could be produced, production of soybeans would have to be reduced by

a) exactly 20 bushels.

b) fewer than 20 bushels.

c) more than 20 bushels.

d) exactly 40 bushels.

17) Refer to Figure 2.6. The best point for society would be

18) In terms of the production possibility frontier, an increase in productivity attributable to new technology would best be shown by

a) a movement along the frontier.

b) the production possibility frontier shifting out and to the

right.

c) a movement from a point inside the frontier to a point on it.

d) a movement toward the origin.

19) The price of good X is $1.50 and the price of good Y is $1.00. If a consumer has experienced a marginal utility of 30 units with the last consumption of good Y, then what must be the marginal utility of the consumer's last consumption of X if the consumer is optimizing correctly across these goods?

a) 30 units.

b) 15 units.

c) 45 units.

d) none of the above.

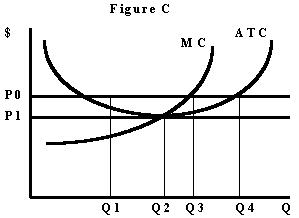

20) In figure C, which quantity decision by a perfectly competitive firm is associated with short-run equilibrium in the industry when the price is P1?

a) Q1.

b) Q2.

c) Q3.

d) Q4.

21) In figure C, a perfectly competitive firm producing Q4 would

a) make a loss regardless if the price is P0 or P1.

b) make economic profit regardless if the price is P0 or P1.

c) necessarily shutdown if price is P1.

d) make a normal profit, but not economic profit if price is P0.

22) In figure C, suppose each perfectly competitive firm was producing Q2 with a market price of P1. An arrangement that would have each firm produce Q1 to raise the market price to P0 so that all firms make economic profit is a

a) cartel.

b) monopoly.

c) natural monopoly.

d) oligopoly.

23) In figure C, if a group of firms could raise price to P0 by each perfectly competitive firm producing Q1, how much would a cheating firm produce to make more economic profit than the rest?

a) Q1.

b) Q2.

c) Q3.

d) Q4.

24) Jerry is a welder earning $15 an hour. Assuming leisure is a normal good, if his employers offer Jerry a wage increase

a) the income effect would tend to make him consume less leisure.

b) the substitution effect would tend to make him work less, as

the real price of leisure

increases.

c) the net effect on the number of hours worked is indeterminate,

as the substitution and income effects work here in opposite directions.

d) both the income and substitution effects would lead him to work

more.

25) Suppose the price of hamburgers falls and you discover that you can eat more hamburgers because they are cheaper than chicken sandwiches. This is an example of

a) the substitution effect.

b) the income effect.

c) the law of diminishing marginal utility.

d) the law of increasing demand.

26) An indifference curve is

a) the set of all points of consumer equilibrium as the consumer's income changes.

b) all combinations of goods X and Y that yield the same total

utility.

c) all combinations of goods X and Y that yield the same marginal

utility.

d) the set of all goods that the consumer can afford given her

income and the prices of the

goods.

27) If the substitution effect of a wage change outweighs the income effect of a wage change, the labor-supply curve is

a) upward sloping.

b) horizontal.

c) vertical.

d) backward bending.

28) If there are external costs of production which are not being accounted for, then

a) marginal cost equals marginal social cost.

b) marginal cost is less than marginal social cost.

c) marginal cost is greater than marginal social cost.

d) marginal social cost is zero.

29) If the government taxes a steel company by an amount equal to the damages of each successive ton of steel, then the steel company's marginal cost curve is the same as the

a) marginal damage cost curve.

b) marginal social cost curve.

c) marginal private cost curve.

d) marginal benefit cost curve.

30) When the government imposes a tax on a firm that generates external costs, the firm will produce

a) more units of output than before the tax was imposed in order to continue maximizing profits.

b) the same number of units of output as before the tax was

imposed to continue maximizing profits.

c) fewer units of output than before the tax was imposed in order

to continue maximizing profits.

d) either more or fewer units of output than before the tax was

imposed depending upon what happens to the profit maximizing level of output.

31) Suppose that you live next door to a limburger cheese factory. The fumes from this cheese factory aggravate your asthma and you have to pay an additional $70 every month for medication. You have tried to find a new place to live, but the only place that is suitable will cost you $150 more in rent than what you currently pay. The efficient solution to this problem is

a) for you to pay the additional $150 in rent and move.

b) for the cheese factory to provide you with the additional $150

per month so that you could move to the new apartment.

c) for you to pay the cheese factory $60 to reduce the fumes.

d) for the cheese factory to compensate you for your additional

medical expenses of $70.

32) The idea that when externalities are present, private parties can arrive at the efficient solution without government intervention under certain circumstances is known as

a) the Coase theorem.

b) Arrow's impossibility theorem.

c) the free-rider problem.

d) the drop-in-the-bucket problem.

33) Because people can enjoy the benefits of public goods whether they pay for them or not, they are usually unwilling to pay for them. This is known as the

a) drop-in-the-bucket problem.

b) nonexcludable problem.

c) nonrival problem.

d) free-rider problem.

34) Once a public good is produced,

a) everyone can consume a different amount depending upon their willingness to buy the

good.

b) everyone consumes the same amount and everyone's willingness to

pay is the same.

c) everyone consumes the same amount, but the willingness to pay

will be different for different individuals.

d) everyone can consume a different amount and pay different

prices for the product.

35) If a buyer or seller enters into an exchange with another party who has more information, there has been

a) moral hazard.

b) adverse selection.

c) a negative externality imposed.

d) a free-rider problem.

36) The advantage in the production of a product enjoyed by one country over another when it uses fewer resources to produce that product than the other country does is

a) a relative advantage.

b) a comparative advantage.

c) an absolute advantage.

d) a productive advantage.

37) Suppose that two countries, Argentina and Chile, are each engaged in the production of two goods: wheat and copper. If Argentina has an absolute advantage in the production of wheat and Chile has an absolute advantage in the production of copper, then

a) there is no basis for trade between the two countries.

b) Argentina should specialize in the production of copper and

Chile should specialize in

the production of wheat.

c) both countries should engage in the production of both goods.

d) Argentina should specialize in the production of wheat and

Chile should specialize in the production of copper.

38) According to comparative advantage, trade between two countries

a) allows each of the trading countries to use its resources most efficiently.

b) guarantees that consumption levels will be equal in the two

countries.

c) will benefit all the industries in each of the countries.

d) maximizes the amount of inputs that are used in the production

of all products.

39) The theory that states that a country has a comparative advantage in the production of a product if that country is relatively well endowed with inputs used intensively in the production of that product is the

a) Ricardo-Malthus theorem.

b) Heckscher-Ohlin theorem.

c) Lucas-Laffer theorem.

d) Friedman-Samuelson theorem.

40) If the United States increases the tariff on imported tuna steaks, this will

a) reduce the number of tuna steaks imported into the United States and reduce production of tuna steaks in the United States.

b) increase the number of tuna steaks imported into the United

States and increase the production of tuna steaks in the United States.

c) reduce the number of tuna steaks imported into the United

States and increase the production of tuna steaks in the United States.

d) increase the number of tuna steaks imported into the United

States and reduce the production of tuna steaks in the United States.

PROBLEM 1: You go to the local fraternity party and there are 3 types of goods you can consume there: Beer, Cheetos and Brownies. You have the following schedule of marginal utility (MU) for each of the products:

Quantity MU_BEER MU_CHEETOS MU_BROWNIES

________________________________________________________________

1st 50 30 40

2nd 42 26 36

3rd 35 22 32

4th 28 15 30

5th 20 10 24

6th 12 5 16

________________________________________________________________

1a) If each quantity of Beer, each quantity of Cheetos, and each quantity of Brownies always costs $1, how many of each will you purchase if you have $10 and you want to maximize your total utility (that is, your satisfaction).

Beer __________

Cheetos __________

Brownies __________

Total utility when you spend your $10 _______________

1b) Suppose your friend has the same marginal utility schedule as shown above and she bought 2 Beers, 6 Cheetos, and 2 Brownies. You notice that she hasn't maximized her utility properly. She hasn't consumed her products yet and the fraternity is will to let her trade in one of her products for another. What trade would you advise to give her the greatest gain in utility?

TRADE: ______________________________________________

NET GAIN IN UTILITY ___________________________________

1c) How would your purchases change at the fraternity if you came the next night to the same type of party, but now the price of beer is $2 instead of $1. Assume you still have $10 to spend and the prices of both cheetos and brownies are still $1.

Beer __________

Cheetos __________

Brownies __________

Total utility when you spend your $10 _______________

PROBLEM 2: Consider the following situation. The small town of Noti has two firms that cause air pollution: a lumber company and a trucking firm. The two firms currently throw 16 tons of pollutants into the air each year and the following table shows how much it would cost each firm to reduce its pollution.

Cost to reduce each ton of pollution

LUMBER CO. TRUCKING CO.

1st Ton $ 1000 $ 900

2nd 2000 1800

3rd 2200 2700

4th 2400 3600

5th 3000 4600

6th 3000 6000

7th 5000 12000

8th 20000 50000

2a) Now suppose that Noti wants to eliminate 10 tons of air pollution. The first option Noti considers is to make both firms eliminate 5 tons of pollution each. What is the cost of pollution elimination for each firm and the total combined cost for both firms (which represent the total cost for society)?

Total cost for Lumber firm __________________

Total cost for Trucking firm __________________

Total combined cost for both firms __________________

2b) Now suppose the town of Noti knows the costs of pollution elimination for each firm as described in the table above. How much would the town make each firm eliminate their pollution to get the same amount of pollution reduction for less combined cost across the two firms? (The reduction of pollution for the firms is not necessarily equal!)

Units of pollution reduction for Trucking firm: ___________________

Units of pollution reduction for Lumber firm:

___________________

Total combined costs of pollution reduction for both firms:

___________________

Explain why this solution in 2b) is more efficient than the solution in 2a).

2c) If instead, the town of Noti decides to have an auction for "rights to pollute 1 ton" in order to reduce 10 tons of pollution, how many "rights to pollute 1 ton" would Noti offer for sale? ______________________________How many rights would the lumber firm buy? _______________________________

How many rights would the trucking firm

buy?

___________________________________

Which method for reducing pollution is more efficient? (that of 2b) or 2c) ?) Explain why.

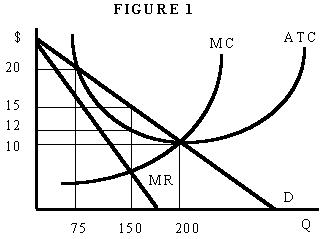

PROBLEM 3: Use figure 1 above to answer the following questions.

3a) Explain why marginal cost (MC) is upward-sloping, as diagramed in figure 1.

PERFECTLY COMPETITIVE INDUSTRY:

Price ________________

Quantity ________________

Total Revenues ________________

Total Costs ________________

Profits

________________

MONOPOLIST:

Price ________________

Quantity ________________

Total Revenues ________________

Total Costs ________________

Profits

________________